Looking into the Future of Data Management

Teresa Wingfield

July 15, 2023

Data management spans the collection, storage, security, access, usage, and deprecation of data. The data management world continues to undergo substantial transformations every year. Here’s a brief look into what’s in store for the future of data management, beginning with data democratization and then delving into how it’s driving the need for easier data access, advanced analytics, and stronger data governance.

Data Democratization

Data democratization, or enabling universal access to data, is going to become an even larger priority for several reasons. Being able to deliver the right data to analysts and front-line employees who need it, in a timely basis, in the right context leads to more effective decisions in the context of their daily work. This, in turn, can help create opportunities to drive new revenue and drive operational efficiencies throughout an organization. Even more importantly, data democratization is crucial to business transformation.

Another factor driving the need for data democratization is the talent shortage for analysts and data scientists, particularly for advanced analytics requiring knowledge of artificial intelligence. With the U.S. Bureau of Labor Statistics projecting a growth rate of nearly 28% in the number of jobs requiring data science skills by 2026, the shortage will continue to grow. Businesses will need to devise strategies for users to easily access data on their own so that limited technical staff doesn’t bottleneck data analytics.

Embedded Analytics and Self Service

The use of embedded analytics and self-service will grow to support the need for data democratization. Self-service gives users insights faster so businesses can realize the value of data faster. Analytics embedded within day-to-day tools and applications deliver data in the right context, allowing sales, marketing, finance, and other departments to make better decisions faster.

According to Gartner, context-driven analytics and AI models will replace 60% of existing models built on traditional data by 2025.

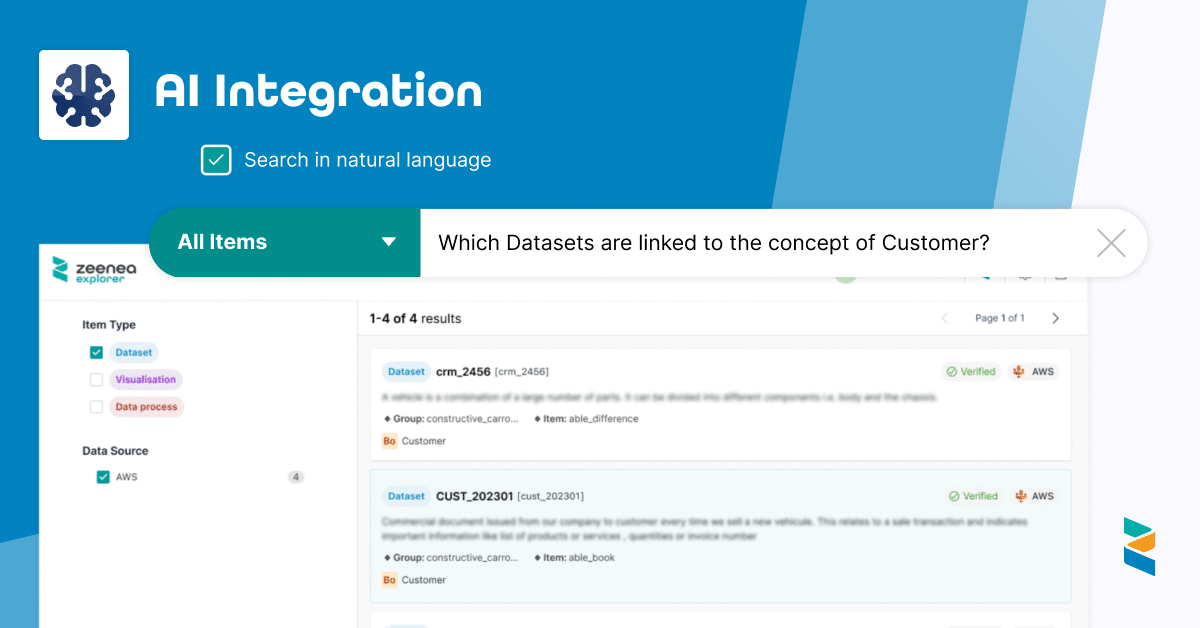

Artificial Intelligence

To truly democratize data, we have to democratize data analytics. Artificial intelligence allows machines to model, and even improve upon, the capabilities of human intelligence. The adoption of artificial intelligence has been growing steadily and is poised to accelerate. A report published by The AI Journal, reveals that 72% of leaders feel positive about the role that artificial intelligence will play in the future, with the number one expectation being that it will make business processes more efficient (74%). 55% believe that artificial intelligence will help to create new business models, and 54% expect it to enable the creation of new products and services.

Data Governance

How do you democratize data while protecting privacy, complying with regulations, and ensuring ethical use? These are exactly the types of challenges that are fueling the growth of data governance to establish and enforce policies and processes for collecting, storing, using and sharing information. Data governance assigns responsibility for managing data, defines who has access to data and establishes rules for using and protecting data, including compliance with regulations such as General Data Protection Regulation (GDPR) and Health Insurance Portability and Accountability Act (HIPAA), state privacy statutes and industry standards such as Payment Card Industry Data Security Standard (PCI DSS).

The future of data management is exciting, putting insights from data in the hands of everyone using embedded analytics, self-service, and artificial intelligence. Backed by strong data governance, businesses are poised to derive even greater growth and innovation using their data.

Additional Resources:

Subscribe to the Actian Blog

Subscribe to Actian’s blog to get data insights delivered right to you.

- Stay in the know – Get the latest in data analytics pushed directly to your inbox.

- Never miss a post – You’ll receive automatic email updates to let you know when new posts are live.

- It’s all up to you – Change your delivery preferences to suit your needs.

Subscribe

(i.e. sales@..., support@...)