Compliance for Banking, Financial Services, & Insurance data

Finally, trust your BFSI data with our data intelligence platform.

Accelerate growth with smarter data discovery

Actian Data Intelligence Platform helps financial services organizations extract maximum value from their existing data assets. Leverage our data discovery platform to:

- Initiate a data-driven strategy.

- Meet demanding data regulations.

- Unlock new value from ever-growing data.

- Gain competitive advantage over InsurTech and FinTech.

- Ensure trusted data governance.

Modernize financial operations with precision discovery

Leverage complete data transparency and governance for organization-wide benefits.

Regulatory compliance

Simplify regulatory compliance with complete visibility and traceability of data assets. Confidently meet evolving regulations while reducing risk, enhancing data governance, and streamlining compliance workflows.

Risk modeling

Empower accurate risk modeling by gaining a unified view of data across diverse sources. Utilize trusted insights to assess and mitigate risks, optimize decisions, and drive resilient strategies with confidence.

Fraud detection

Enhance fraud detection by benefitting from real-time data transparency and accessibility. Quickly identify anomalies, reduce false positives, and strengthen security measures for proactive fraud prevention.

Data transparency and monetization

Take advantage of full data transparency and give teams access to reliable, traceable data. Empower better decision-making, strengthen compliance, and foster a culture of accountability across the organization.

Personalized customer experiences

Deliver personalized customer experiences by unifying data insights across channels. Tailor interactions, anticipate needs, and build stronger customer relationships that drive loyalty and satisfaction.

Real-time decision-making

Leverage real-time data insights for faster, smarter decision-making. Contextualize customer interactions and automate time-sensitive processes to deliver rapid, data-driven results that meet the demands of today’s fast-paced digital landscape.

Empowering financial services with data solutions

Universal connectivity

Our universal connectivity and API-first approach allows the Actian Data Intelligence Platform to adapt to any system, and to any data strategy (edge, cloud, multi-cloud, cross-cloud, hybrid) to build an enterprise-wide information repository.

We provide the most comprehensive connectivity of the market with the ability to automate metadata curation with our wide range of connectors.

Built-in flexibility

Our platform provides modular metamodel templates that enable banks and insurance companies to quickly and incrementally build easy-to-use and comprehensive models to serve business needs and regulatory reports.

Structure your assets’ documentation with simple “drag & drop” features and create documentation templates for each type of asset in the way that works best for you.

Powerful automation

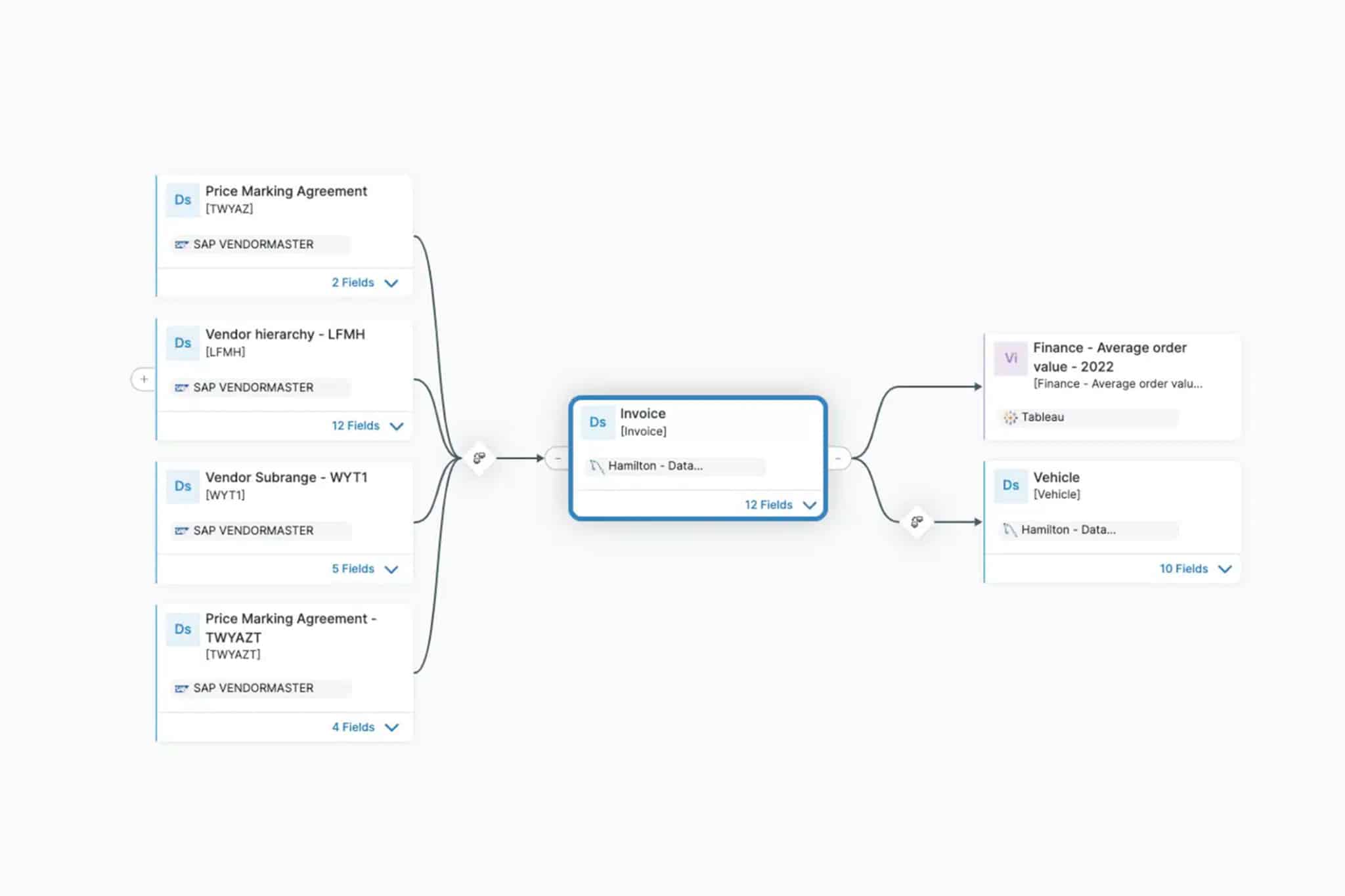

Actian Data Intelligence Platform automates data lineage by gathering data processes and data asset transformations from ETL platforms and data pipelines, or from manual descriptions for compliance and regulation.

Our solution also provides an audit trail for any action done in the data catalog.

Two dedicated apps

Both of our applications provide all your data consumers with sharing capabilities to allocate their knowledge on various objects in the catalog through collaborative features.

Thus, interactions between teams and experts will be simplified and the aggregation of knowledge acquired during use cases will finally be possible.

Boosting Data Capabilities

Secure, innovate, and elevate experiences with enterprise data intelligence.

Join our 30-minute live demo

Discover why top enterprises are switching to the Actian Data Intelligence Platform, designed for ease of use, collaboration, and cost-efficiency. Join us for a demo to explore why this is the last data catalog you’ll ever need.

You’ll discover how to:

- Simplify data discovery with our knowledge graph architecture.

- Track comprehensive data lineage for compliance.

- Prepare AI-ready data products for business and technical teams.

When to attend:

Fill out the form to see available dates.

All demos are 8am PST | 11am EST | 5pm CEST.